Now Reading: 7 Money Beliefs That Are Keeping You Broke (And How to Replace Them)

-

01

7 Money Beliefs That Are Keeping You Broke (And How to Replace Them)

7 Money Beliefs That Are Keeping You Broke (And How to Replace Them)

Tired of living paycheck to paycheck? Break free from these 7 common money beliefs that keep you broke — and learn how to replace them with empowering ones.🧠 Introduction: What If It’s Not the Budget — But the Belief?

We all want more money — to feel secure, travel, pay off debt, and live freely. But what if the thing that’s holding you back… isn’t your job or your income, but your money beliefs?

Your mindset around money — what you believe to be true — has the power to attract wealth or repel it. And most of these beliefs? We inherited them. From our parents, our culture, our past mistakes.

In this guide, we’re going to uncover the 7 most common money beliefs that are keeping you broke — and more importantly, how to flip them into beliefs that build wealth instead.

💭 1. “I Don’t Make Enough Money to Save”

This belief keeps people stuck at every income level. It’s not about how much you make — it’s about what you do with what you have.

🔄 Replace It With:

“I pay myself first — no matter how small.”

Even $5 saved consistently builds the habit of saving. Use automated tools or try the strategy I used in this post.

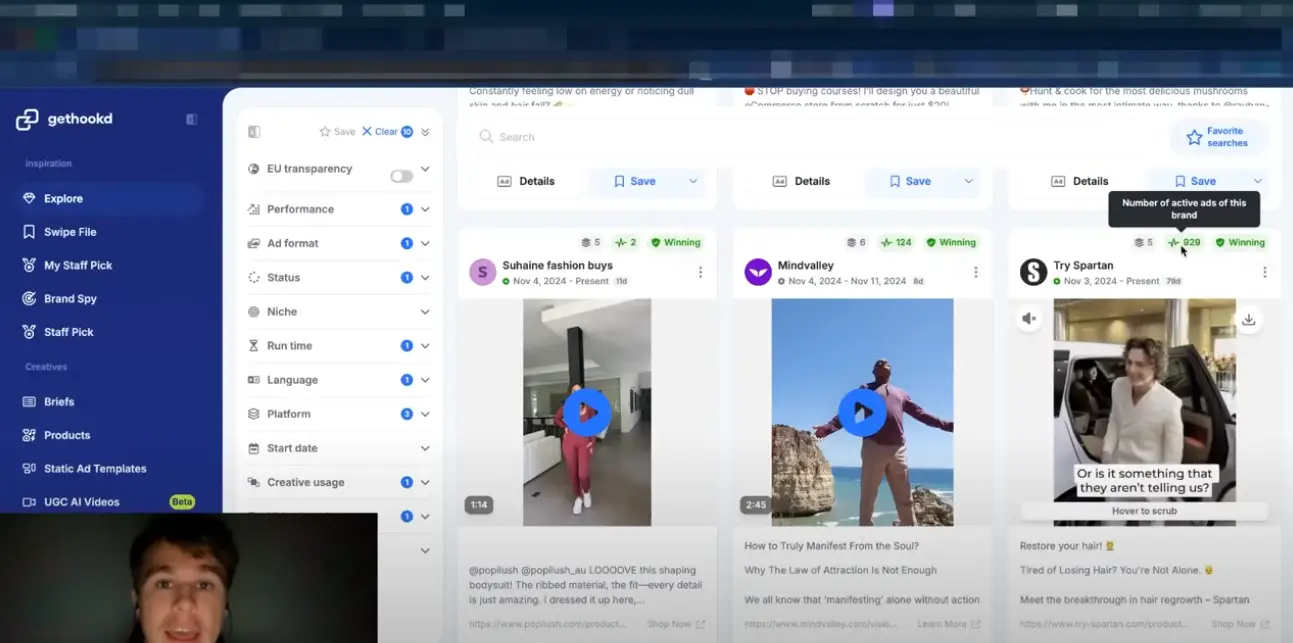

💸 2. “Money Is Hard to Manage”

Believing money is complicated leads to avoidance. You stop checking your accounts, ignore budgeting, and let anxiety take over.

🔄 Replace It With:

“I can learn systems that make money easy.”

You don’t need to become an accountant. Use beginner tools like Notion, YNAB, or budgeting apps like these to start small and grow confident.

🚫 3. “Debt Is Normal”

Debt is common — but it’s not normal. And it’s definitely not freedom.

🔄 Replace It With:

“Debt is a tool — not a lifestyle.”

Use debt strategically (if at all), and aim to minimize consumer debt aggressively. Use zero-based budgeting to redirect every dollar toward freedom.

🧱 4. “I’m Just Bad with Money”

This is one of the most dangerous beliefs. It lets you off the hook from learning, improving, or changing.

🔄 Replace It With:

“I’m becoming someone who understands money.”

Learning money is a skill — not a personality trait. You can develop it like any other skill. Check out these habits I used to shift my mindset.

🧠 5. “I Have to Work Hard to Earn Money”

Effort is important — but exchanging time for money is the most limiting model of income.

🔄 Replace It With:

“Money flows to systems and value — not just effort.”

This belief shift is why I started exploring passive income platforms and automated tools like these.

🛑 6. “If I Had More Money, I’d Be Fine”

More money won’t fix poor money habits — it’ll magnify them.

🔄 Replace It With:

“I build habits now, so more money helps me — not hurts me.”

Practice financial habits now, even with limited funds. Track spending, review your accounts weekly, and automate your savings.

🔐 7. “People Like Me Don’t Get Rich”

Whether it’s your background, education, or past — believing wealth is for “others” makes it a self-fulfilling prophecy.

🔄 Replace It With:

“Wealth is learnable, buildable, and scalable.”

Many people are now building income online through AI-powered side hustles, digital products, and freelancing with no experience. Why not you?